Comprehensive Wealth Planning

Focused on Your Unique Goals and Needs

We’ll work together to build a financial approach that reflects your life, your goals, and what matters most to you.

From retirement to taxes and investments, we help connect all the dots so your finances feel clear and manageable.

Life changes, and so does your plan. We stay connected to adjust and keep things on track as your needs grow and shift.

You’ll have access to a network of caring professionals ready to support you and simplify even the trickiest financial details.

GET YOUR FREE GUIDE

The Importance of Designating Beneficiaries

When life gets hectic and your to-do list seems endless, it can be easy to let financial planning details slip through the cracks. However, updates to your designated beneficiaries on 401(k) plans, IRA accounts, and other retirement assets is vitally important.

Smart Solutions for Every Stage of Your Financial Journey

Guidance designed for individuals nearing or in retirement, focusing on income strategies and maintaining financial stability during this transition.

Explore ways to reduce your tax burden through careful planning, leveraging deductions, and optimizing your financial structure.

Create a plan to protect your assets, ensure your wishes are honored, and leave a meaningful legacy for your loved ones or causes you care about.

Develop a diversified portfolio aligned with your goals, balancing growth opportunities and risk to suit your stage in life.

Support for entrepreneurs planning to sell or transition their business, with strategies for tax management, legacy planning, and family considerations.

Protect your future with tailored risk mitigation and health care planning strategies, designed to address uncertainties and ensure comprehensive coverage for life's unexpected challenges.

Ready to take the first step toward simplifying and organizing your financial life?

Request your 15-minute discovery call today and explore how our personalized approach can help align your wealth with your goals.

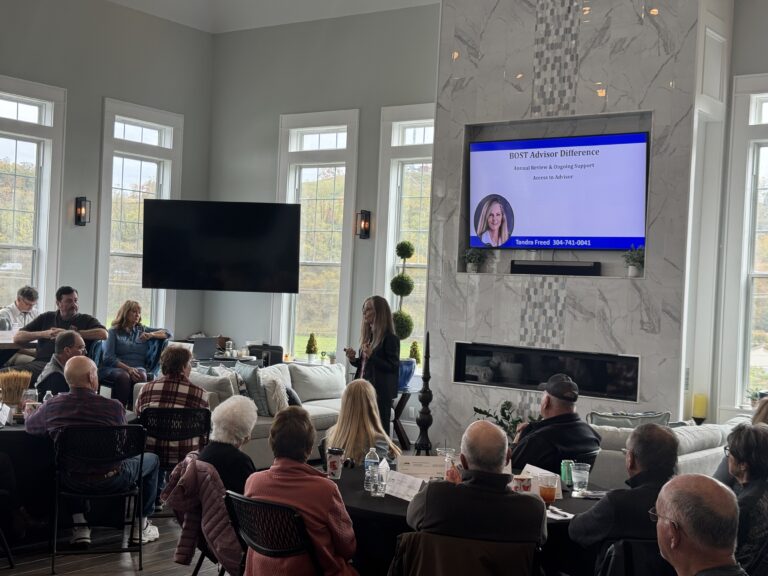

Beacon Wealth Management Draws Crowd for Medicare Planning Event Focused on 2026 Changes

Bridgeport, WV – October 28, 2025 – Beacon Wealth Management continues to guide West Virginians on the journey to a confident retirement with another Wisdom 2 Wealth Luncheon success story. On October 24, 2025, community members filled the event space for an insightful and engaging session on “Medicare Planning: What’s Changing and What You Need to Know for 2026.” With sweeping updates to Medicare on the horizon, attendees learned how to stay ahead of the changes, avoid costly mistakes, and align their healthcare decisions with their overall retirement plan. Guest expert Tandra Freed delivered an engaging, easy-to-understand presentation on

Investment Tax Management: Balancing Portfolio Growth and Tax Efficiency

When it comes to investing, finding the right balance between growing your portfolio and being smart about taxes is key. The truth is that investment tax management can play a significant role in boosting your overall returns by reducing the amount of taxes you owe. Whether you’re focused on capital gains, dividends, or other taxable events, understanding how to minimize your tax burden while still aiming for strong portfolio growth is crucial. In this guide, we’ll explore practical strategies to help you optimize your portfolio for tax efficiency without giving up on growth potential. It’s all about keeping more

Proactive Retirement Planning: Starting with Your End Goal in Mind

Retirement is a significant milestone, marking a shift from earning an income to relying on savings and investments to support your lifestyle. Proactive retirement planning requires a clear vision of what you want your future to look like, and then working backward to build a strategy that brings that vision to life. By focusing on your end goals early in the process, you can create a roadmap that aligns with your aspirations while preparing for the financial realities of retirement. In this article, we’ll explore how starting with your end goal in mind can lead to more effective retirement