Bridgeport, WV – October 28, 2025 –

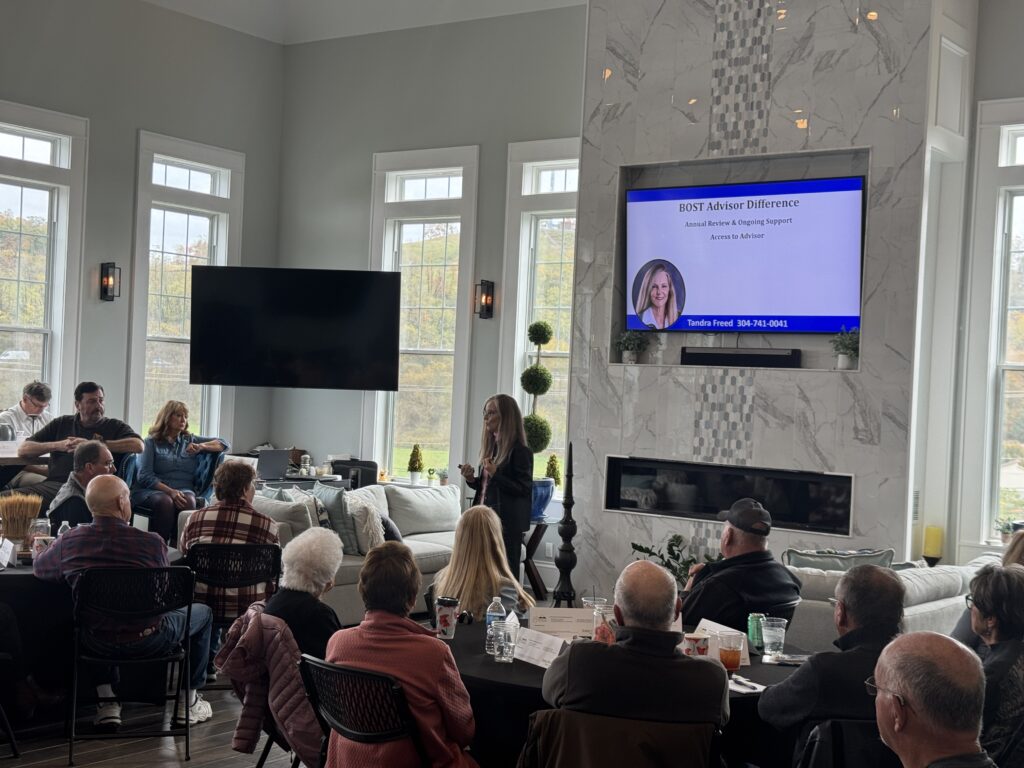

Beacon Wealth Management continues to guide West Virginians on the journey to a confident retirement with another Wisdom 2 Wealth Luncheon success story. On October 24, 2025, community members filled the event space for an insightful and engaging session on “Medicare Planning: What’s Changing and What You Need to Know for 2026.”

With sweeping updates to Medicare on the horizon, attendees learned how to stay ahead of the changes, avoid costly mistakes, and align their healthcare decisions with their overall retirement plan.

Guest expert Tandra Freed delivered an engaging, easy-to-understand presentation on topics including:

- Key Medicare updates for 2025 and what’s coming in 2026

- Changes to prescription coverage and out-of-pocket limits

- How Medicare Advantage and Supplement Plans may shift

- Tips to prevent late enrollment penalties and gaps in coverage

“This event was about empowerment through education,” said John Halterman, Senior Wealth Advisor at Beacon Wealth Management. “We believe retirees deserve clarity and confidence when it comes to their future—and that starts with understanding how healthcare and financial planning work hand-in-hand.”

Beacon Wealth Management’s Wisdom 2 Wealth Event Series has become a sought-after educational experience for those approaching or enjoying retirement. Each session provides timely insights, expert perspectives, and actionable strategies designed to help individuals live life unscripted.

To learn more about upcoming Wisdom 2 Wealth events or to reserve your seat for the next luncheon, visit www.bwmwv.com or call 304-626-3900.

About John Halterman and the Beacon Wealth Management Team

At John Halterman and the Beacon Wealth Management Team, we believe the adventure begins with retirement — and we’re here to help you live life unscripted. Our experienced team specializes in guiding individuals and families through the critical years leading up to and through retirement. We provide personalized, client-focused strategies designed to help people move forward with clarity and confidence. Rooted in trust, integrity, and care, we build lasting relationships while helping clients protect what they’ve worked hard for and create a financial future they can feel good about.